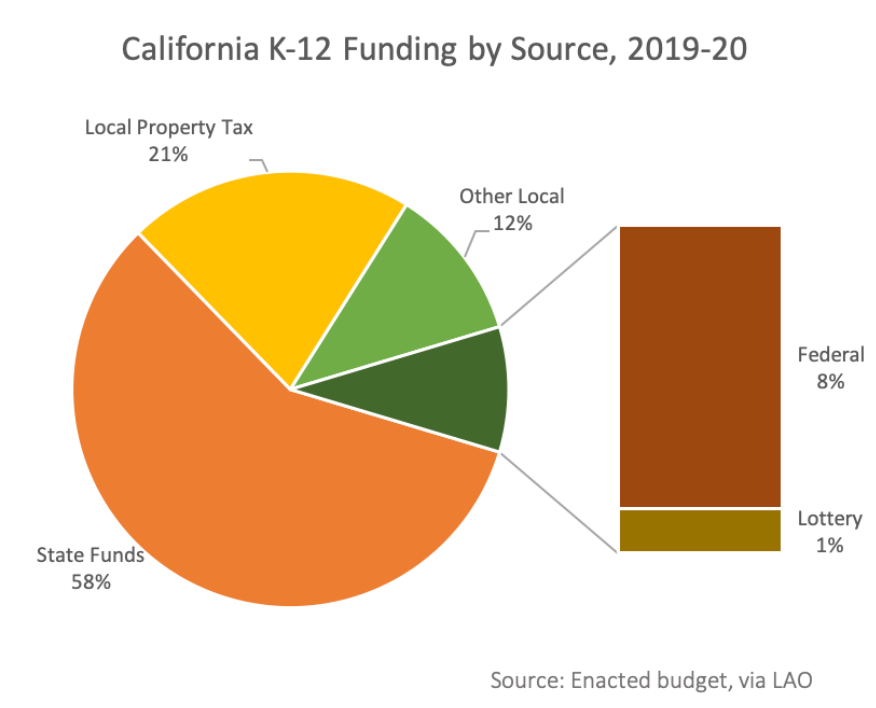

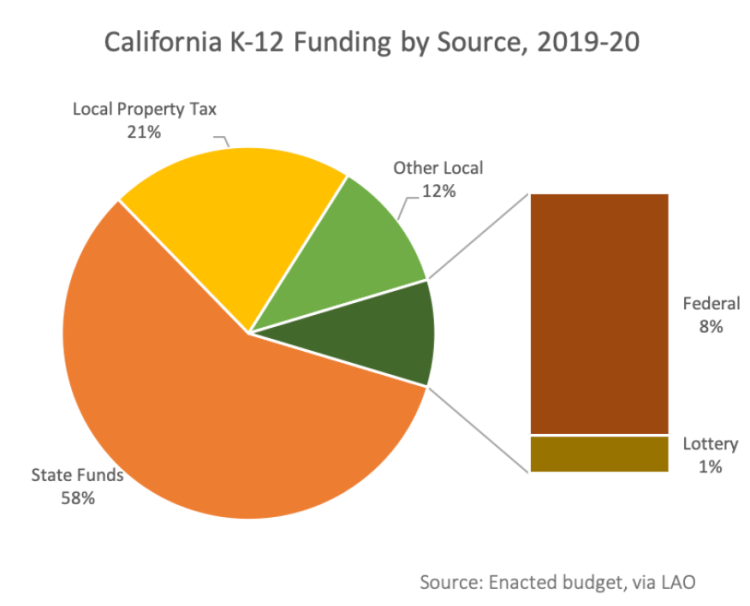

California’s education funding depends on taxes and the California tax system is extremely complex. California has a huge tax base, as a matter of fact, California is the fifth largest economy in the world. California ranks high in overall taxation, but its major revenue sources have shifted over time(Lin, 2020). Until 1995, the biggest revenue source was property taxes; today it is personal income taxes. In 2018, the state was projected to spend $78.3 billion from its own revenue sources on 6 million students in K-12 public schools(Lin, 2020). While that may seem like a lot when you do the math that amounts to approximately $11,000 per student. Money needed desperately to educate students equitably and adequately. Since, the budget is so dependent on taxes, it’s important to understand how taxes work.

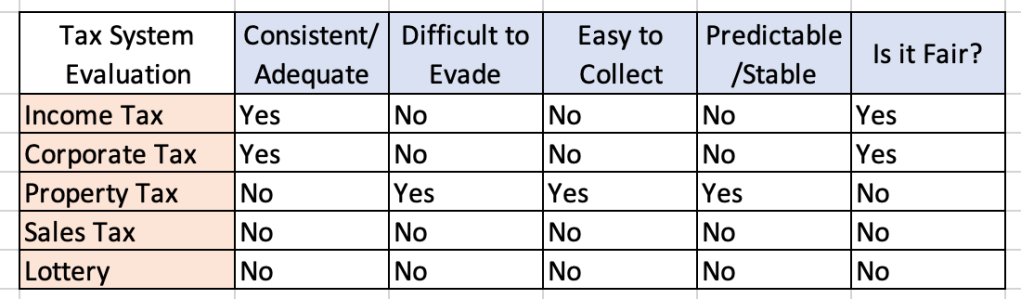

Because all citizens, and in some instances like sales taxes, sin taxes, and the lottery, even noncitizens pay taxes, a good tax system distributes the burden it creates among all people in an equitable manner. Most tax systems today are based on what is called “the ability to pay;” taxes are paid according to a person’s financial capacity or ability (Brimley et al., 2016). All tax systems can be judged on five basic criteria. Is the tax consistent or adequate, difficult to evade, easy to collect with very little bureaucracy, are they predictable or stable, and are they fair?

First you must understand the three different types of taxes: progressive, proportional, and regressive (Horton, 2021). By evaluating whether a tax is progressive, proportional, or regressive you can decide on whether a tax is fair or equitable. Progressive taxes take a larger percentage of income from high income groups than low-income groups. Proportional taxes tax at the same percentage from all income groups. Proportional taxes sometimes referred to as a flat tax affect low-, middle-, and high-income earners relatively equally because they pay the same tax rate regardless of income. Whereas the progressive tax has a more of a financial impact on higher income individuals than on lower income earners (Horton, 2021). An example of a progressive tax system would be the federal income tax guidelines. Regressive taxes take a larger percentage of income from low-income groups than high income groups, not dollar amount, but percentage or portion of their income. Regressive taxes are taxes that are paid regardless of incomes, things like sales tax, what we call sin tax (taxes on items like tobacco and alcohol) and property taxes (Horton, 2021). These three types of taxes are applied to all tax systems: property tax, income tax, sales tax, corporate tax, and other taxes like the lottery, or local taxes like vehicle license fees.

So, let’s discuss a few of the types of taxes in California that are used to fund public services like education.

Income Tax

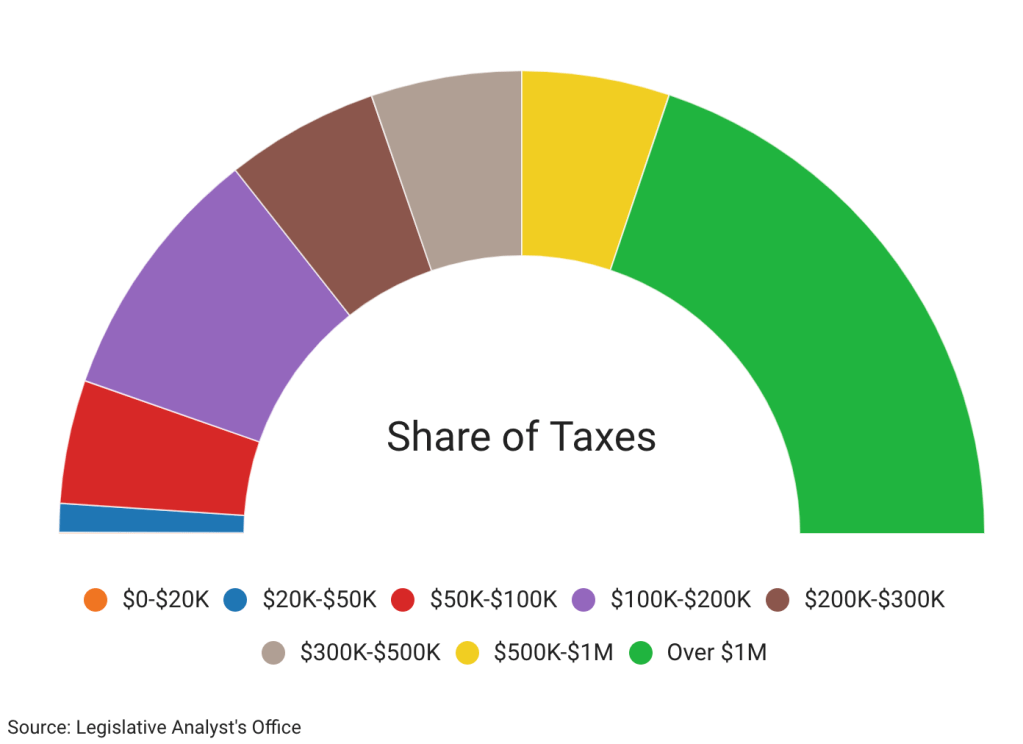

With income tax revenue being the largest portion of the state’s budget it’s interesting to note that according to the legislative analyst’s office, half of the state’s personal income tax revenue come from those making $500,000 or more (Lin, 2020). Conversely, households making $50,000 or less make up nearly 60% of tax filings but only 2% of the revenue for the state. Income tax is considered a progressive tax that is levied on annual income. If you’ve ever paid taxes, you know that the tax system is very complex and income tax is not easy to collect. When it comes to bureaucracy, I think one of the number one group that comes to mind would be the IRS. Taxes can be easy to evade. For example, those who are paid cash under the table may not be paying taxes at all. Income tax can be considered stable in the sense that it is productive and though there may be some fluctuations in the overall amount of revenue making it less predictable it is not something that is going away anytime soon (Ingento et al., 2007). While it is stable, you can’t predict with any guarantee the taxes the state will receive from one year to the next. Income tax is very vulnerable to market fluctuations. Consider things like being in the middle of a pandemic and thousands of people being out of a job, the tax revenue base decreases significantly.

Sales Tax

Sales tax is a levy imposed on certain goods and services in California, mostly on goods and very few services. Though California is one of the higher tax regions, California taxes less services than some other states who also impose sales tax (Lin, 2020). This is good and not so good at the same time. Some would argue that by not taxing a larger number of services, the state is losing out on revenue. Sales taxes are considered regressive because the tax rate is the same on those goods regardless of your income. This means that a simple purchase of some groceries has a greater tax impact on a lower income family than a higher income family even though the tax rate is the same, because that tax is a much larger portion of the lower income family’s income and therefore a larger burden. Sales taxes are also not dependable, they are very volatile and depend on market strength and consumer spending; there is no way to accurately predict or guarantee sales tax revenue. Another thing that makes sales tax unreliable is the fact that it’s difficult to collect (Ingento et al., 2007). It is difficult in the sense that local counties can impose higher tax rates and so some taxes are paid out at higher rates while others are at lower rates. The burden of collecting those taxes is placed on sellers who then report those taxes and pay them to the government leaving opportunities for tax evasion. For example, vendors who operate heavily in cash can greatly underestimate their sales and therefore pay less taxes. Also, simple things like e-commerce provides ways for people to avoid taxes. For example, when a person in the state of California purchases an item that is taxable from a business at their storefront, that item is paid out in taxes, however, if an individual in California orders a similar item from a business outside of California online, they won’t be charged that same tax.

Lottery Tax

The lottery is also a taxation that was created to help fund schools (Brimley et al., 2016). The lottery only taxes those who participate. If you don’t want to pay into the lottery then don’t buy a ticket, making evasion rather simple. The lottery unfortunately is very expensive to run and has a high overhead cost especially when you consider the large payouts that incentivize people to participate. The lottery is not considered consistent or adequate, because the amount of revenue gained is only about 1% of the school budget and that is not enough(Murphy & Paluch, 2018). Additionally, like the sales tax the lottery is very volatile and there is no guaranteed level of revenue. Also, it is again a regressive tax because those who play don’t pay different amounts depending on their income.

Property Tax

Property taxes are another source of income for California, but as stated earlier it is not the largest source of revenue like it has been in the past. Property taxes are desirable as a form of taxation because it is a direct tax on those who own homes and very difficult to evade and easy to collect. Another reason why property taxes are considered desirable is that they are relatively stable or predictable meaning the revenue collected doesn’t change with the market volatility. In California, proposition 13 put a cap property taxes. Under proposition 13 a property’s tax rate is based on the property’s original purchase price and then every subsequent year that tax can only increase by 2%, or the rate of inflation, whichever is lower (Lin, 2020). This means that even if the assessed value of a home has significantly increased, those buyers under the proposition 13 tax law will not be assessed taxes at that higher value. The intention of prop 13 was to help people on fixed incomes stay in their homes, but an unintended side effect has created a large disparity among neighbors depending on when they purchased the home. For example, if a home was purchased back in the early 80s that home is taxed at the property’s purchase price in the 1980s, and under proposition 13 family members can pass their home on to their dependents and maintain that lower tax rate. At the same time the house right next door which has been sold to a new family now pays taxes on that home, which is the same age and style as the other home, at the current market value rates. Wealthy people who purchased property are also being able to take advantage of proposition 13 because even though their income is higher their taxes remain at the lower rate. Many argue that proposition 13 has denied local governments and schools’ large amounts of revenue and that is partially why property taxes are not the largest source of income for the state of California (Ingento et al., 2007). These factors make property taxes mostly consistent, but less than it could be. When considering property taxes on the surface it would seem to be a progressive tax in that wealthier people can afford more expensive homes and therefore pay higher property taxes, but with laws like proposition 13 that is not always the case and sometimes it can be a regressive tax disproportionately costing more or lower income families or simply preventing them from even having the opportunity to purchase property.

Corporation Tax

California is one of 45 states to collect corporation taxes; taxes based on corporate profits. Corporation taxes are the state’s third largest source of general fund revenues (Ingento et al., 2007). Corporate taxes are applied to all corporations that earn income through sources in California. Nonprofits such as churches and charitable organizations are exempt. Interestingly, insurance companies are not part of the corporate tax structure, instead they pay something called a gross premium tax which is different than the corporate tax. Because the corporate tax is based on profits those businesses that report losses are subject to only the states minimum tax. About 55% of businesses in California actually report profits (Ingento et al., 2007). The corporate tax has three individual taxes the franchise tax, income tax, and bank tax. The franchise tax is paid by most businesses in the state of California just for the privilege of doing business in California. The bank taxes paid by banks and financial institutions. The corporate income taxes are paid by businesses that don’t have sufficient presence in California to pay the franchise tax. Like personal income tax the corporate tax is progressive. An example of this is that corporations earning a taxable income of 500,000 or more represented only 3% of returns but had 87% of the tax liability (Ingento et al., 2007). Similar also to the personal income tax, bureaucracy is a major component of collecting these taxes and the tax system is very complex. While there has been relatively good growth in corporate taxes, uses of tax shelters and creative accounting practices can certainly be ways of evading payment. Along the same lines of personal income taxes and sales taxes, corporate income tax is relatively predictable and stable but is also subject to market volatility as well as the ability of the state of California to be desirable for doing business and competitive with other states who may provide incentives for businesses to leave California.

Conclusions

With California’s revenue depending heavily on income tax, which is more volatile than property tax, and less property tax revenues, California schools are more dependent on state funds than schools are in most other states. The reality is California’s tax structure is very complex and California is spending less on education because of policy choices. The state directs fewer resources to education than do other states and its chosen tax sources are volatile making education funding vulnerable during economic downturns.

Resources

Brimley, V., Verstegen, D., & Garfield, R. (2016). Financing education in a climate of change (Twelfth). Pearson Education Inc.

California’s Tax Sytem A Visual Guide. (2015). Legislative Analysts Office. https://lao.ca.gov/reports/2018/3805/ca-tax-system-041218.pdf

Horton, M. (2021, January 1). Regressive, Proportional, and Progressive Taxes: What’s the Difference? Investopedia. https://www.investopedia.com/ask/answers/042415/what-are-differences-between-regressive-proportional-and-progressive-taxes.asp

Ingento, R., O’Malley, M., Stanley, M., & Taylor, C. (2007, April). California’s Tax System: A Primer. Legislative Analyst’s Office. https://lao.ca.gov/2007/tax_primer/tax_primer_040907.aspx

Lin, J. (2020, September 17). The open secret about California taxes. CalMatters. https://calmatters.org/explainers/the-open-secret-about-california-taxes/

Murphy, P., & Paluch, J. (2018, November). Financing California’s Public Schools. Public Policy Institute of California. https://www.ppic.org/publication/financing-californias-public-schools/